Who is the Mad fientist?

He is one of my favourite FI bloggers and has recently hit financial independence in his mid thirties. The Mad Fientist analyses the tax code and looks at personal finance through the lens of early financial independence, he develops strategies and tactics to help you retire even earlier.

What does the Mad fientist do to achieve financial independence?

Join the Mad Fientist as he interviews personal-finance icons like Mr. Money Mustache and Vicki Robin to discover the strategies they used to achieve financial independence and retire early! Learn about investing, tax avoidance, entrepreneurship, travel hacking, real estate, and all things related to financial independence and early retirement!

Who can benefit from the Mad fientist?

Most personal finance advice is geared towards people retiring in their 60s or later and doesn’t apply to those pursuing early financial independence. The Mad Fientist focuses on providing advice and innovative tax-avoidance methods specifically for people wanting to break away from full-time employment very early in life.

When did Mad Mad fientist move back to Scotland?

Mad Fientist We moved back to Scotland in August of 2014. And in that point I was planning on just quitting my job for good. I’d hit the number that I was targeting and that was a perfect time coz I was so wanted to move back to Scotland. Yeah.

Life Goals First, Money Second

Neither of us have ever been interested in being rich just for the hell of it. Okay, well there was that one time Mr. ONL owned a slightly extravagant car.

Constraining Our Spending Without Budgeting

Budgets aren’t a good fit for us. We’ve tried, we’ve failed, we’ve moved on. But we are able to live on what we have, so we’ve followed an automated strategy of paying ourselves first that makes the balance in our checking account artificially low.

Leaving the Big City

We are huge believers in aiming toward the life that you’ll love living, not just the life that’s the cheapest, so we’d never advocate leaving the city if you love city life. And we actually did love city life, but we suspected we’d also love mountain life, since the mountains are our true love, apart from each other of course.

Not Inflating Our Lifestyle

The most painless way to save by far is just to stick to the spending level you feel comfortable at, and when you get raises and promotions, automatically save that extra money. While some more hardcore frugal bloggers have continued the college lifestyle into their 30s, we didn’t do that at all.

Banking Our Windfalls

In addition to banking raises, we’ve made a habit for many years of banking windfalls, like our year-end deferred compensation or any tax refunds we might get. It started by just deliberately not budgeting how we’d spend that money.

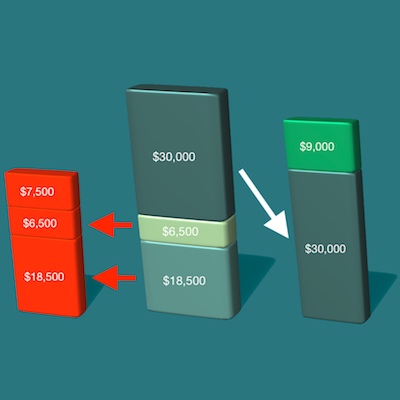

Thinking Through Sequencing

While the 4 percent rule (and its corollary, the rule of 25x) is a good rough measure of what you might need to save to retire, it doesn’t account for real-world circumstances, like that you might have more saved in your 401 (k) or other tax-advantaged accounts than you have in your taxable funds (this is true in our case).

Lots of Contingencies

We may be setting a record for the number of contingency plans we have, but that’s important to us.