The best investing podcasts for investing beginners in 2021

- Industry focus. The industry focus podcast from The Motley Fool delivers episodes covering a specific industry.

- Market Foolery. This is a great podcast from the Motley Fool where they dig into stock news. ...

- Motley Fool Money Podcast. Motley Fool Money airs every week and is similar to Market Foolery. ...

Full Answer

What are the best podcasts on investment?

- Study tips

- English communication

- Spiritual teachers

- Motivation

- Stories

What is the Best Podcast for entrepreneurs?

The 4 Best Podcasts for Entrepreneurs Starting Out

- Success Stories. Popular financial expert, author and television personality Farnoosh Torabi’s podcast, So Money, offers a wide range of financial advice in an entertaining interview platform.

- Avoiding Scams. The Clark Howard Show focuses on making the most of every dollar through being an educated consumer.

- Advice from the Experts. ...

How do you start a podcast as a beginner?

- Set a definite date and time for publishing

- Have one evergreen recorded podcast (As a backup plan)

- Mention Website link at the start & end of Show notes

- Use an animated video overlay and publish your podcast on YouTube.

- Connect with best minds in your industry by inviting them to be a guest on your podcast show.

What stocks should I buy as a beginner investor?

What to look for while investing in the stock market?

- Who are you?: Before you even think about investing in the best stocks for beginners, understand if you are an investor or a speculator. ...

- How long can I stay invested?: This crucial step helps in selecting the kind of stocks to invest in as a beginner. ...

- Risk profile: Unlike a bank FD, stock market investments do not guarantee the safety of principal. ...

Where do I start investing podcasts?

Top 3: Best Investing Podcasts OverallThe Investing for Beginners Podcast. Andrew and Dave are two regular guys who didn't go to school for finance. ... The Canadian Investor. ... The Acquirers Podcast. ... The Ramsey Show. ... Stacking Benjamins. ... Invest Like the Best. ... Motley Fool Money. ... The Money Tree Investing Podcast.

Where should I start as a beginner investor?

Best investments for beginnersHigh-yield savings accounts. This can be one of the simplest ways to boost the return on your money above what you're earning in a typical checking account. ... Certificates of deposit (CDs) ... 401(k) or another workplace retirement plan. ... Mutual funds. ... ETFs. ... Individual stocks.

What should a beginner invest in?

Here are six investments that are well-suited for beginner investors.401(k) or employer retirement plan.A robo-advisor.Target-date mutual fund.Index funds.Exchange-traded funds (ETFs)Investment apps.

How do I teach myself to invest?

Learn to Invest: How to Teach YourselfBuy and read investing books. ... Learn the investing terminology. ... Attend any company meetings for employees. ... Start reading fund prospectuses. ... Follow & read personal finance websites. ... Take an investing online course. ... Learn from stock simulators. ... Start investing with little money.More items...•

How much money do I need to invest to make $1000 a month?

Assuming a deduction rate of 5%, savings of $240,000 would be required to pull out $1,000 per month: $240,000 savings x 5% = $12,000 per year or $1,000 per month.

What are the 4 types of investments?

There are four main investment types, or asset classes, that you can choose from, each with distinct characteristics, risks and benefits.Growth investments. ... Shares. ... Property. ... Defensive investments. ... Cash. ... Fixed interest.

What small investments make money?

Here are a few of the best short-term investments to consider that still offer you some return.High-yield savings accounts. ... Short-term corporate bond funds. ... Money market accounts. ... Cash management accounts. ... Short-term U.S. government bond funds. ... No-penalty certificates of deposit. ... Treasurys. ... Money market mutual funds.

Is it better to invest or save money?

Saving is definitely safer than investing, though it will likely not result in the most wealth accumulated over the long run. Here are just a few of the benefits that investing your cash comes with: Investing products such as stocks can have much higher returns than savings accounts and CDs.

How do beginners invest in stocks with little money?

One of the best ways for beginners to learn how to invest in stocks is to put money in an online investment account, which can then be used to invest in shares of stock or stock mutual funds. With many brokerage accounts, you can start investing for the price of a single share.

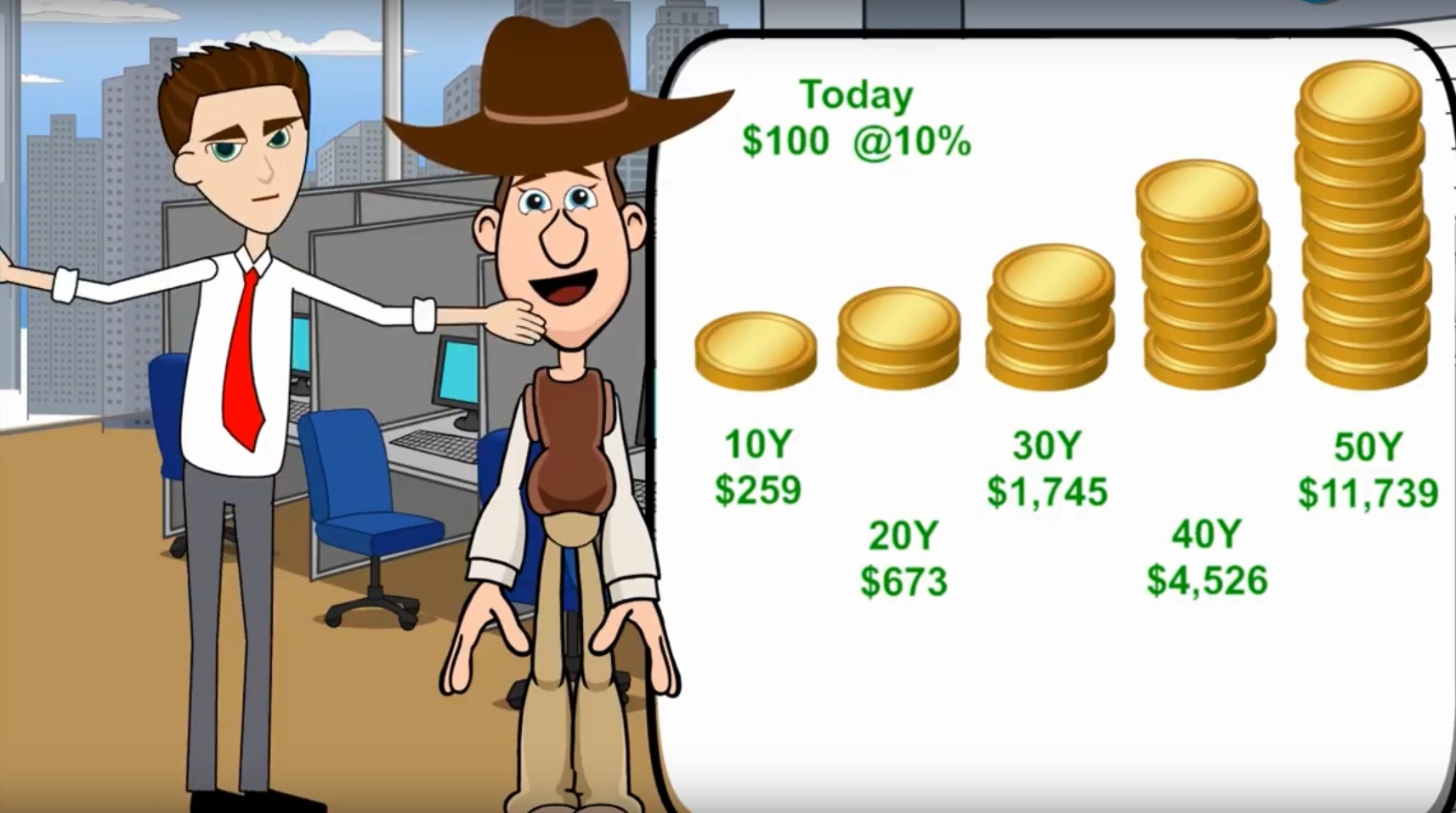

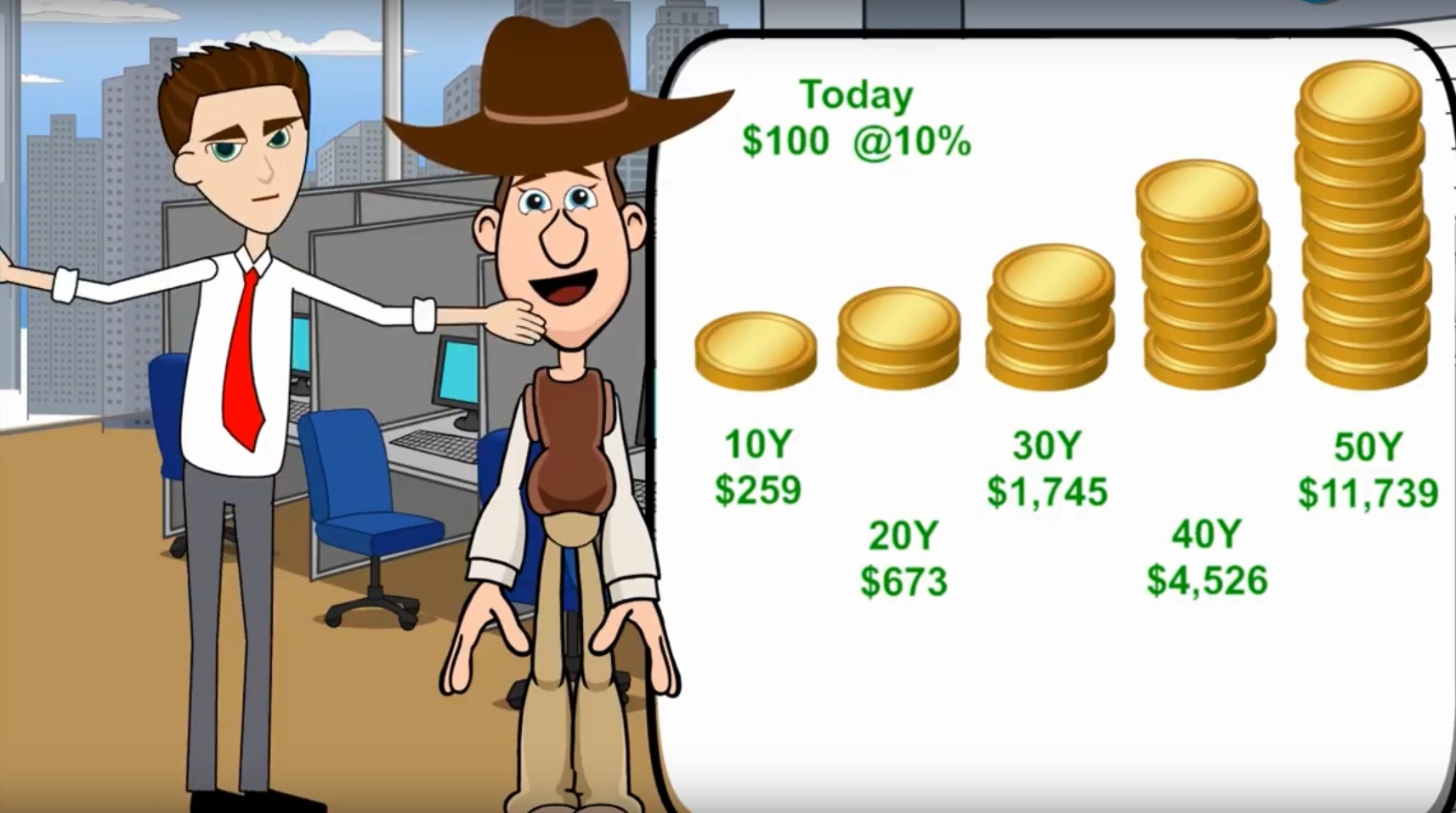

How can I invest with $100?

Our 6 best ways to invest $100 starting todayStart an emergency fund.Use a micro-investing app or robo-advisor.Invest in a stock index mutual fund or exchange-traded fund.Use fractional shares to buy stocks.Put it in your 401(k).Open an IRA.

Is investing hard to learn?

Investing isn't difficult. You don't have to be a math genius to understand where to put your money or be afraid of scary terms like “stock market volatility.” (That just means the prices of companies in the stock market are changing rapidly.) The more you know, the better you'll feel about investing.

How long does it take to learn to invest?

If you're learning in your spare time, you should expect to commit at least 40 hours to structured learning, which you might have to spread over a couple of months. The keys are to learn at a comfortable pace and to use a stock trading course that provides constant feedback on your learning progress.

How do I start investing with little money?

Buy Fractional Shares of Stocks and ETFs. ... Invest Your Spare Change. ... Dollar-Cost Average Into Low-Cost ETFs or Mutual Funds. ... Invest in Stablecoins on a High-Interest Rate Platform. ... Lend Your Money for High Interest With Peer-To-Peer Lending. ... Own a Piece of Real Estate Through REITs and Crowdfunding.More items...•

Can I start investing with $1000?

$1,000 is enough to make a single stock purchase through an online brokerage reasonable. You do lose some money in the transaction itself, but the right stock can return many times the transaction costs.

How much money do I need to start investing?

You don't need a lot of money to start investing. In fact, you could start investing in the stock market with as little as $10, thanks to zero-fee brokerages and the magic of fractional shares. Here's what you need to know about how to transform even a small amount of money into the beginnings of an investment empire.

Is Robinhood good for beginners?

Robinhood is a pioneer in the no-commission brokerage model. It remains a solid choice for beginners, as they can invest in stocks, ETFs, options, and cryptocurrencies with zero commissions.

Quick Tips and Recaps

With episodes ranging from 15 to 20 minutes, these podcasts are short and sweet, but tell you everything you need to know going on in finance.

Add Some More Context

Learn to talk the talk when it comes to finance by listening to these stock market and economy explainers.

Dive Deeper

Tune into these in-depth discussions to learn personal finance tips, prepare for everyday financial decisions and situations, and find out how famous investors earned their way to the top.

Sponsor Center

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

What are the formats of podcasts?

A podcast can be in different formats such as: 1 Monolog 2 Interview 3 Moderator

Is listening to podcasts good?

Conclusion. Listening to podcasts is an excellent way of learning new topics. I think it’s a good idea to listen to different types of investment podcasts. Some podcasts cover the latest news, and some include more evergreen topics.

What is Morningstar investment?

Morningstar is a widely recognized name in the investing world, even among the most novice investors. The investment research firm is a go-to source for reviews and ratings of specific securities, including stocks, mutual funds, and exchange-traded funds.

How to invest in your 20s?

As you move through different life stages, your investment priorities and goals may shift, along with the amount of risk you're willing to take, and those changing attitudes should be reflected in the makeup of your portfolio. Paul Merriman's Sound Investing podcast, which began as a radio show two decades ago, tackles the different issues investors may encounter with fine-tuning their portfolios as they navigate various life stages.

What is real estate investment?

Real estate, for example, is a specific subset of investing that has an entirely different set of considerations and expectations, apart from investing in stocks or funds. Under that broad umbrella, you may niche down further into self-storage investing or vacation rentals.

What is an investment podcast?

An investing podcast typically covers money management, investment-specific information such as strategies, risk analysis, and how current events and politics affect the stock market. Investing podcasts can also cover fiscal policy, investment news, international news, taxes, and real estate.

What is investment in investing?

Investing, generally, involves putting money into vehicles that have the potential for higher growth than a traditional or high yield savings account. Stocks, mutual funds, exchange-traded funds, and bonds are just some of the things you might consider putting your money into.

Do investing podcasts provide financial advice?

An investing podcast doesn’t provide financial advice and isn’t a way to get rich quick.

Who is the host of the College Investor podcast?

Host Robert Farrington is a self-described Millennial Money Expert and he uses The College Investor podcast as a platform for educating college students and recent grads on the fundamentals of investing and building wealth.

What is investment in a corporation?

Investment is an opportunity for you to buy an asset in one’s corporation and grow your investment as the corporation does. The possibility of this opportunity has extended as wide as the awareness of the Stock Market and Investing. People are more likely to invest than to research before investing, which is why Investment’s generally otherwise known as “Risk”.

Who can explain business perfectly other than the Co-founder of Linkedin and former COO of PayPal himself, Reid

Who can explain business perfectly other than the Co-founder of Linkedin and former COO of PayPal himself, Reid Hoffman. Like his work, you would blindly decide to take advice from him. He’s a generous person filled with the interest to describe investments in a deliberative manner. The episodes are 30-40 minutes long and air on Masters Of Scale, Spotify, Apple Podcasts and Google Podcasts.

Do podcasts waste your time?

Despite the large variety of Podcasts, every beginner MUST check them out, as they never lack information and would be worth investing time in. Whether it’s the Dave Ramsey or the Motley Fool Money, Podcasts never waste your time. They are sweet, short, must-hear files that can save your data, time, and the most significant, MONEY.

Who is Patrick O'Shaughnessy?

Patrick O’Shaughnessy has produced one of the best introductory podcasts for beginners in the realm of Investments. He questions his guests the perfect and demanding questions which are needed to ask on the basics of various investment ideas. He has been producing his well-known series “Cryptocurrency” since 2017, which would unquestionably teach you the basics.

Middle 3 of the Top Investing Podcasts

4. The Dave Ramsey Show The best thing you can do to get started with investing is to get your own financial books in order. Getting out of debt and learning to live below your means will help you achieve your financial goals faster than anything else. This show is inspirational, educational, and also entertaining.

Bottom 2 of the Top Investing Podcasts

7. Motley Fool Money This show does a solid job rounding up the latest earnings reports and news around the stock market from week to week. I appreciate the fundamental analysis that gets included with these recaps, and by listening to this podcast regularly you can get updated on the latest narratives around the stock market and Wall Street.

How many podcasts will be released in 2020?

There are over 1.5 billion podcasts globally as of Oct. 2020, according to PodcastHosting.org. 1 . If you are looking to expand your investing knowledge, learn from top financial experts, or stay up-to-date on important market-moving news, here are 10 investing podcasts for you.

How long is the episode of O'Shaughnessy?

Episode release date: Tuesdays. Average episode duration: 60 minutes. Patrick O'Shaughnessy, CEO of O'Shaughnessy Asset Management, speaks with investors, founders and CEOs to capture and share the world’s best business and investing knowledge.

How long is the Rich Poor Dad show?

The Rich Dad Show. Episode release date: Wednesdays. Average episode duration: 45-60 minutes. Robert Kiyosaki, author of Rich Poor Dad, sits down with investing, business, and personal development professionals to provide listeners with various perspectives on how to set themselves up for financial success.

Who interviewed Warren Buffet?

Preston Pysh and Stig Brodersen interview and study famous financial personalities, including Warren Buffet and Howard Marks, to teach listeners important lessons learned and how to apply their investment strategies in the stock market.

Who is Elana Duré?

Elana Duré is a markets writer for Investopedia. She covered shareholder activism as a reporter at Reorg and Activist Insight and her work has been published in The Washington Post, Chicago Tribune, and The Jerusalem Post.